Starting a personal finance blog in 2024 is a fantastic way to share your knowledge, help others achieve financial independence, and even generate income. Whether you’re passionate about budgeting, investing, debt management, or frugal living, creating a blog can establish you as an authority in your niche. This beginner’s guide will walk you through each step to successfully launch and grow your personal finance blog.

1. Define Your Niche and Target Audience

a. Identify Your Niche

Personal finance is a broad field. To stand out, narrow down your focus to a specific area, such as:

- Budgeting and Saving: Tips on managing expenses and saving money.

- Investing: Guidance on stocks, real estate, cryptocurrencies, etc.

- Debt Management: Strategies for paying off debt.

- Financial Independence and Early Retirement (FIRE): Achieving financial freedom.

- Frugal Living: Living well on a tight budget.

- Personal Finance for Specific Groups: e.g., students, freelancers, parents.

b. Understand Your Target Audience

Determine who you want to reach.

- Demographics: Age, gender, income level, education.

- Psychographics: Interests, values, financial goals, challenges.

- Pain Points: What financial problems are they trying to solve?

Example: If you choose “Personal Finance for Young Professionals,” your content might focus on student loan repayment, first-time investing, and budgeting for new incomes.

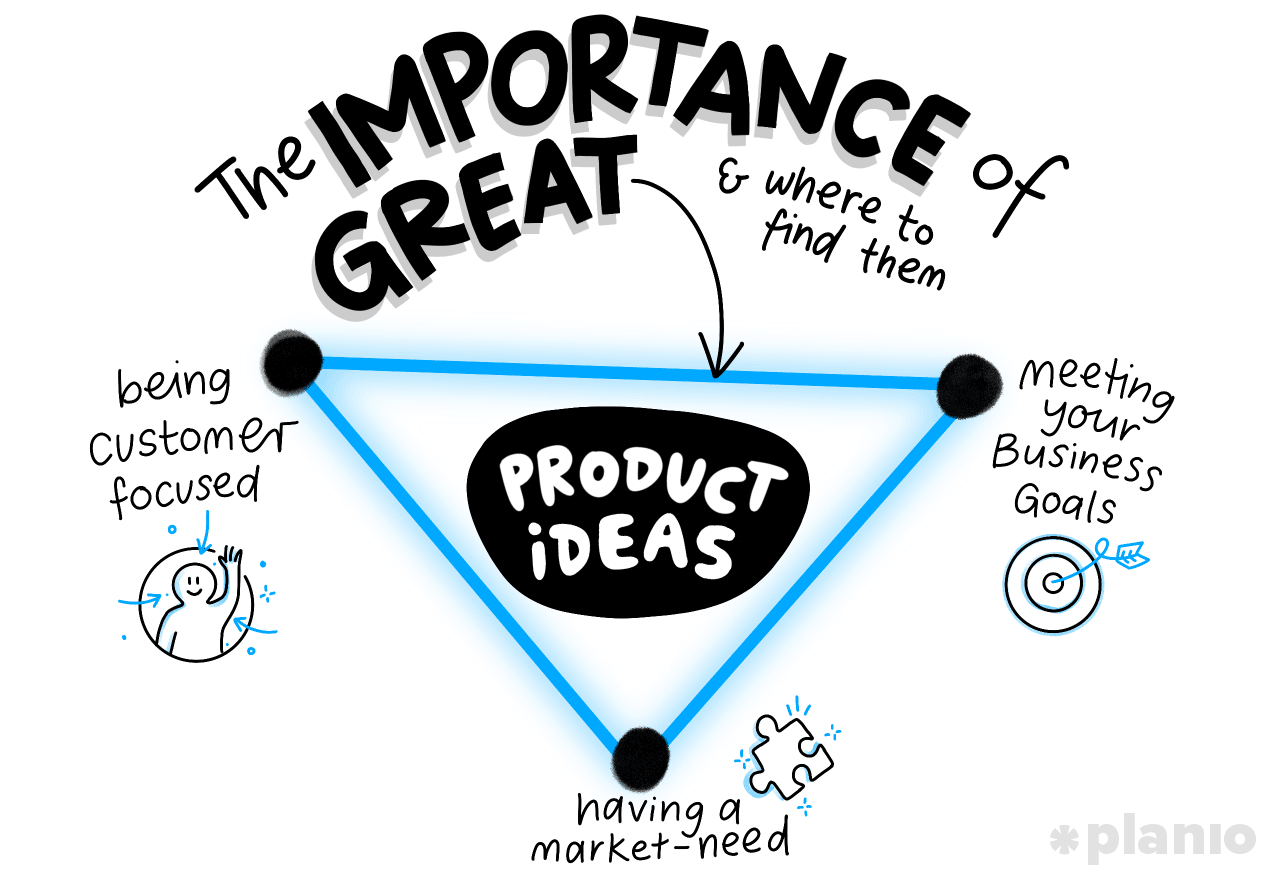

2. Research and Validate Your Idea

a. Analyze Competitors

- Identify Existing Blogs: Look for blogs in your chosen niche.

- Evaluate Their Content: What topics do they cover? What’s their writing style?

- Find Gaps: Is there a subtopic they’re missing or a unique angle you can offer?

b. Validate Demand

- Keyword Research: Use tools like Google Keyword Planner, Ahrefs, or SEMrush to find popular search terms.

- Social Media and Forums: Check platforms like Reddit, Quora, and finance-related Facebook groups to see what questions people are asking.

3. Choose a Blogging Platform

a. Self-Hosted vs. Hosted Platforms

- Self-Hosted (e.g., WordPress.org):

- Pros: Full control, customizable, better SEO.

- Cons: Requires more setup and maintenance.

- Hosted Platforms (e.g., WordPress.com, Wix, Squarespace):

- Pros: Easier to set up, less technical maintenance.

- Cons: Limited customization; less control over monetization.

Recommendation: WordPress.org is highly recommended for its flexibility, extensive plugin ecosystem, and control over your content and monetization.

4. Choose a Domain Name and Hosting

a. Selecting a Domain Name

- Keep It Simple and Memorable: Easy to spell and pronounce.

- Reflect Your Niche: Incorporate keywords related to personal finance if possible.

- Avoid numbers and hyphens. They can be confusing and hard to remember.

- Check Availability: Use domain registrars like Namecheap or GoDaddy.

Example: “SmartMoneyGuide.com” or “BudgetSavvyLife.com”

b. Choose a Reliable Hosting Provider

Consider factors like uptime, speed, customer support, and scalability.

Popular Hosting Providers:

- Bluehost: Officially recommended by WordPress, affordable, good support.

- SiteGround: Excellent performance and customer service.

- A2 Hosting is known for speed and reliability.

- HostGator is budget-friendly with decent features.

Recommendation: Bluehost is a great starting point for beginners, offering easy WordPress integration.

5. Design Your Blog

a. Choose a Theme

Select a WordPress theme that is:

- Responsive: Mobile-friendly design.

- Clean and Professional: Easy to navigate and visually appealing.

- Customizable: Allows you to tweak colors, fonts, and layouts.

Popular Themes for Personal Finance Blogs:

- Astra is lightweight and highly customizable.

- GeneratePress is fast and flexible.

- Divi is feature-rich with a drag-and-drop builder.

b. Customize Your Design

- Branding: Create a logo and choose a color scheme that reflects your blog’s personality.

- Navigation: Ensure your menu is clear and easy to use.

- Essential Pages:

- Home: Overview of your blog.

- About: Your story and mission.

- Blog: Your posts.

- Contact: How readers can reach you.

- Privacy Policy and Disclosures: Important for legal compliance, especially if you’re monetizing.

6. Create quality content.

a. Develop a Content Strategy

- Content Types:

- How-To Guides: Step-by-step instructions on financial topics.

- Listicles: e.g., “10 Ways to Save Money Every Month.”

- Personal Stories: Share your own financial journey and lessons learned.

- Interviews: Feature experts in personal finance.

- Content Calendar: Plan your posts in advance to ensure consistency. Aim for at least 1-2 posts per week initially.

b. Focus on Value and Quality

- Research Thoroughly: Ensure your information is accurate and up-to-date.

- Be clear and concise. Write in an easy-to-understand language.

- Use Visuals: Incorporate images, infographics, and charts to enhance understanding.

- Engage Your Readers: Encourage comments, questions, and interaction.

c. Optimize for Readability

- Use headings and subheadings. Break the content into sections.

- Short Paragraphs: Enhance readability.

- Bullet Points and Lists: Make information digestible.

- Proofread: Eliminate grammar and spelling errors.

7. Optimize for SEO

a. Keyword Research

Identify relevant keywords that your target audience is searching for. Use tools like:

- Google Keyword Planner

- Ahrefs

- SEMrush

- Ubersuggest

b. On-Page SEO Best Practices

- Title Tags: Include primary keywords and keep them under 60 characters.

- Meta Descriptions: Compelling summaries with keywords (under 160 characters).

- URL Structure: Clean and keyword-rich URLs.

- Header Tags: Use H1 for titles and H2-H6 for subheadings.

- Internal Linking: Link to your own relevant content.

- External Linking: Reference authoritative sources.

c. Technical SEO

- Site Speed: Optimize images; use caching plugins like WP Super Cache or W3 Total Cache.

- Mobile Optimization: Ensure your site is mobile-friendly.

- Secure Website (HTTPS): Use an SSL certificate.

- XML Sitemap: Submit to Google Search Console.

- Fix Broken Links: Regularly check and fix 404 errors.

d. Content SEO

- Use Keywords Naturally: Avoid keyword stuffing.

- Optimize Images: Use alt text with relevant keywords.

- Engaging Content: Longer, in-depth posts tend to rank better.

- Regular Updates: Keep your content fresh and updated.

8.Promote Your Blog

a. Social Media Marketing

- Choose Platforms Wisely: Focus on platforms where your audience is active (e.g., Twitter, Facebook, LinkedIn, Pinterest).

- Share Your Content: Promote each new post across your social channels.

- Engage with Followers: Respond to comments and participate in discussions.

b. Email Marketing

- Build an Email List: Use tools like Mailchimp, ConvertKit, or MailerLite.

- Offer Incentives: Free eBooks, checklists, or financial templates for subscribers.

- Send Regular Newsletters: Share new posts, tips, and exclusive content.

c. Networking with Other Bloggers

- Join Blogging Communities: Participate in forums, Facebook groups, or LinkedIn groups related to personal finance and blogging.

- Collaborate: Guest post on other blogs; invite others to guest post on yours.

- Attend Webinars and Conferences: Connect with like-minded individuals and industry experts.

d. Content Marketing and Guest Posting

- Write Guest Posts: Contribute to established personal finance blogs to reach a wider audience.

- Repurpose Content: Turn blog posts into videos, infographics, or podcasts to reach different audiences.

e. Search Engine Marketing (SEM)

- Paid Ads: Consider using Google Ads or social media advertising to drive traffic, especially when starting out.

9. Monetize Your Blog

a. Affiliate Marketing

- Join Affiliate Programs: Promote financial products like credit cards, investment platforms, and budgeting tools.

- Earn Commissions: Receive a percentage for each sale or lead generated through your referral links.

b. Sponsored Posts and Partnerships

- Collaborate with Brands: Write posts sponsored by financial companies or products.

- Maintain Transparency: Always disclose sponsored content to maintain trust.

c. Display Advertising

- Google AdSense: Display ads on your blog and earn per click/impression.

- Media.net: An alternative to AdSense.

- Direct Ad Sales: Sell ad space directly to companies.

d. Create and Sell Your Own Products

- EBooks and Courses: Develop in-depth guides or courses on personal finance topics.

- Templates and Tools: Budget spreadsheets, financial planners, etc.

- Consulting Services: Offer personalized financial advice or coaching.

e. Membership or Subscription Models

- Exclusive Content: Offer premium articles, webinars, or resources to paying members.

- Community Access: Create a private forum or group for subscribers.

10. Engage with Your Audience

a. Respond to Comments and Emails

- Build Relationships: Show readers that you value their input.

- Foster a Community: Encourage discussions and interactions among your audience.

b. Solicit Feedback

- Surveys and Polls: Ask your readers what topics they want to learn about.

- Comments and Suggestions: Use reader feedback to improve your content.

c. Personal Connection

- Share Your Journey: Let readers get to know you personally.

- Be authentic. Authenticity builds trust and loyalty.

11. Analyze and Improve

a. Use Analytics Tools

- Google Analytics: Track website traffic, user behavior, and other key metrics.

- Google Search Console: Monitor your site’s presence in Google search results.

b. Track Key Performance Indicators (KPIs)

- Traffic Metrics: Page views, unique visitors, bounce rate.

- Engagement Metrics: Time on site, pages per session, social shares.

- Monetization Metrics: Affiliate clicks, ad revenue, product sales.

c. Optimize Based on Data

- Identify High-Performing Content: Create more on similar topics.

- Improve Low-Performing Content: Update, optimize, or remove underperforming posts.

- A/B Testing: Experiment with headlines, layouts, and calls-to-action to see what works best.

12. Stay Consistent and Patient

a. Maintain a Regular Posting Schedule

- Consistency Builds Trust: Readers know when to expect new content.

- SEO Benefits: Regular updates can improve search engine rankings.

b. Manage Your Expectations

- Growth takes time. Building an audience and monetizing your blog don’t happen overnight.

- Stay Persistent: Keep producing quality content and promoting your blog even when progress seems slow.

13. Additional Tips

a. Legal Considerations

- Disclosures and Disclaimers: Clearly disclose affiliate links and sponsored content.

- Privacy Policy: Inform users about data collection and usage.

- Terms of Service: Outline the rules for using your site.

b. Continuous Learning

- Stay Updated: Personal finance is a dynamic field. Keep up with the latest trends, laws, and tools.

- Improve Your Skills: Enhance your writing, SEO, and marketing skills through courses and resources.

c. Leverage Tools and Resources

- SEO Tools: Ahrefs, SEMrush, and Yoast SEO (WordPress plugin).

- Design Tools: Canva for creating graphics.

- Email Marketing: Mailchimp, ConvertKit.

- Content Management: Trello and Asana for organizing your content calendar.

d. Optimize for Mobile

Ensure your blog is fully responsive, as a significant portion of traffic comes from mobile devices.

Conclusion

Starting a personal finance blog in 2024 is an exciting venture that requires careful planning, dedication, and continuous effort. By defining your niche, creating valuable content, optimizing for SEO, and engaging with your audience, you can build a successful blog that not only helps others achieve financial well-being but also provides you with opportunities for income and personal growth.

Remember, persistence and adaptability are key. Stay committed to your goals, keep learning, and adjust your strategies based on what works best for your audience. Good luck on your blogging journey!

Resources to Get You Started

- WordPress.org: https://wordpress.org/

- Canva: https://www.canva.com/

- Google Analytics: https://analytics.google.com/

- Ahrefs Blog: https://ahrefs.com/blog/

- Mailchimp: https://mailchimp.com/

- Yoast SEO Plugin: https://yoast.com/wordpress/plugins/seo/

FAQ’s

1. How much does it cost to start a personal finance blog?

Answer:

Starting a personal finance blog can cost anywhere from $50 to $200 upfront, depending on the tools and services you choose. Essential expenses include:

- Domain Name: Typically $10–$15 per year.

- Web Hosting: Around $3–$10 per month (e.g., Bluehost, SiteGround).

- Theme: Free themes are available, but premium themes can cost $30–$100.

- Plugins and Tools: Many are free, but premium plugins can add to the cost.

Over time, you may also invest in premium tools, email marketing services, and advertising, which can increase your expenses.

2. Do I need to have financial expertise to start a personal finance blog?

Answer:

No, you don’t need to be a financial expert to start a personal finance blog. While having some knowledge helps, you can start by sharing your own experiences and what you’ve learned. As you research and write, your expertise will grow. It’s important to be transparent about your level of experience and always strive to provide accurate, well-researched information to your readers.

3. How can I attract traffic to my new personal finance blog?

Answer:

Attracting traffic takes time and effort. Here are a few strategies:

- Search Engine Optimization (SEO): Optimize your content for search engines using relevant keywords.

- Social media: Share your posts on platforms where your target audience is active.

- Guest Blogging: Write guest posts for established blogs to reach a wider audience.

- Networking: Engage with other bloggers and participate in online communities.

- Email Marketing: Build an email list and send regular newsletters to keep your audience engaged.

4. How long does it take to start making money from a personal finance blog?

Answer:

It typically takes 6 months to a year to start earning consistent income from a personal finance blog, depending on factors like content quality, traffic, and monetization strategies. Early income may come from affiliate marketing or ads, but it often takes time to build a substantial audience and income stream. Patience, consistency, and strategic monetization are key to achieving financial success with your blog.

5. What are the best ways to monetize a personal finance blog?

Answer:

Common monetization strategies for personal finance blogs include:

- Affiliate Marketing: Earn commissions by promoting financial products or services.

- Sponsored Content: Partner with brands to create sponsored posts.

- Display Advertising: Use platforms like Google AdSense to display ads on your site.

- Selling Digital Products: Offer eBooks, courses, or financial tools.

- Consulting or Coaching: Provide personalized financial advice or coaching services.

It’s important to choose monetization methods that align with your blog’s content and audience needs.

These FAQs should help beginners feel more confident about starting their own personal finance blog.

links https://futurefounderss.com/ https://makeemoneyy.com/ https://makeemoneyy.com/7-proven-ways-to-make-an-extra-1000-a-month/