Affordable Insurance Tips: How to Save Money and Secure Your Future

Insurance is a vital part of financial planning, offering protection against unexpected events that could otherwise drain your savings. Whether it’s health, auto, home, or life insurance, having the right coverage can safeguard your financial well-being. However, many people struggle with finding affordable insurance that doesn’t compromise on coverage. In this article, we’ll explore practical tips on how to save money on insurance while ensuring you have the protection you need. We’ll also discuss common mistakes to avoid and how to make informed decisions when selecting an insurance plan.

1. Understand Your Insurance Needs

Before you start shopping for insurance, it’s crucial to understand your specific needs. Different types of insurance serve different purposes, and your personal situation will dictate what kind of coverage you require.

- Health Insurance: Do you need comprehensive coverage, or would a high-deductible plan work better if you’re generally healthy?

- Auto Insurance: How much coverage do you need based on your vehicle, driving habits, and the state you live in?

- Homeowners Insurance: Does your policy cover natural disasters like floods or earthquakes, which might be relevant depending on where you live?

- Life Insurance: Do you need term life insurance, which is cheaper, or whole life insurance, which is more expensive but offers more benefits?

Tip: Make a list of your insurance needs and priorities. This will help you focus on the essential coverage areas without getting overwhelmed by optional extras that might not be necessary.

2. Shop Around for the Best Rates

One of the most effective ways to save money on insurance is to compare rates from different providers. Prices can vary significantly between companies, even for the same coverage.

- Use Online Comparison Tools: Websites like Policygenius and The Zebra allow you to compare quotes from multiple insurers.

- Consult an Independent Agent: Independent agents work with multiple insurance companies and can help you find the best deal.

- Check for Discounts: Many insurers offer discounts for bundling multiple policies, having a good driving record, or installing safety features in your home or car.

Table 1: Average Savings by Shopping Around for Insurance

| Insurance Type | Average Savings (%) | Comparison Period (Years) |

|---|---|---|

| Auto Insurance | 15-20% | Every 2–3 Years |

| Home Insurance | 10-15% | Every 3–4 Years |

| Health Insurance | 10-20% | Annually |

Tip: Don’t just look at the price; consider the coverage limits, deductibles, and customer service reputation of the insurance company as well.

3. Bundle Your Policies

Bundling multiple insurance policies with the same provider can lead to significant savings. Most insurance companies offer discounts when you combine auto, home, and even life insurance policies.

- Auto and Home Insurance Bundles: Combining these two can often save you up to 25%.

- Adding Life Insurance: Some insurers offer additional discounts if you add life insurance to your bundle.

- Other Types: Depending on the insurer, you might also be able to bundle renters, motorcycle, or boat insurance.

Tip: While bundling can save money, make sure that each policy individually meets your needs. Sometimes the savings from bundling may not be worth it if one policy is overpriced or lacks adequate coverage.

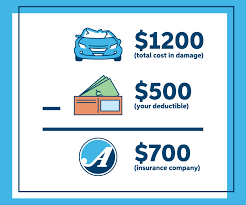

4. Raise Your Deductible

Your deductible is the amount you pay out of pocket before your insurance kicks in. By opting for a higher deductible, you can lower your monthly premiums.

- Aut

o Insurance: Increasing your deductible from $500 to $1,000 could reduce your premium by 10–20%.

o Insurance: Increasing your deductible from $500 to $1,000 could reduce your premium by 10–20%. - Home Insurance: A higher deductible can lower your annual premium by up to 25%, depending on the insurer.

Tip: Make sure you have enough savings to cover the higher deductible in case of an emergency. It’s not worth the lower premium if you can’t afford to pay the deductible when needed.

5. Take Advantage of Discounts

Many insurance companies offer a variety of discounts that can help reduce your premiums. Some of these are easy to qualify for, while others might require a bit more effort.

- Good Driver Discounts: Many auto insurers offer discounts to drivers with a clean driving record.

- Home Safety Discounts: Installing security systems, smoke detectors, or storm shutters can earn you discounts on your homeowners insurance.

- Health and Wellness Discounts: Some health insurers offer lower premiums if you participate in wellness programs or quit smoking.

Table 2: Common Insurance Discounts and Their Average Savings

| Discount Type | Insurance Type | Average Savings (%) |

|---|---|---|

| Good Driver | Auto Insurance | 10-30% |

| Security Systems | Home Insurance | 5-15% |

| Wellness Programs | Health Insurance | 5-20% |

| Multi-Policy Discount | Multiple | 10-25% |

Tip: Always ask your insurance provider about available discounts. Sometimes, insurers don’t automatically apply discounts you qualify for, so it’s worth inquiring.

6. Maintain a Good Credit Score

In many states, insurance companies use your credit score to determine your premiums. A higher credit score often translates to lower insurance costs.

- Pay Bills on Time: Late payments can negatively impact your credit score.

- Reduce Debt: Keeping your credit utilization low (below 30%) can improve your score.

- Check Credit Reports: Regularly review your credit report for errors and dispute any inaccuracies.

Tip: Improving your credit score can take time, but it can lead to substantial savings on your insurance premiums in the long run.

7. Review Your Policy Annually

Your insurance needs can change over time, so it’s important to review your policies annually. This ensures you’re not overpaying for coverage you no longer need or underinsured in critical areas.

- Life Changes: Major life events like marriage, the birth of a child, or buying a new home can affect your insurance needs.

- Policy Adjustments: You might find that you can reduce coverage in certain areas to save money, or you might need to increase coverage in others.

- Discounts and Offers: New discounts or better deals might be available that weren’t there when you first bought your policy.

Tip: Set a reminder to review your insurance policies every year, ideally a month before renewal. This gives you time to make any necessary changes.

8. Consider Usage-Based or Pay-As-You-Go Insurance

For auto insurance, usage-based or pay-as-you-go plans can be an affordable option, especially if you don’t drive often.

- Telematics Devices: These devices monitor your driving habits, such as speed, braking, and mileage, and can lower your premiums based on safe driving behavior.

- Mileage-Based Plans: Some insurers offer lower rates for drivers who travel less than a certain number of miles per year.

Tip: If you opt for a usage-based plan, make sure you’re comfortable with the level of monitoring involved and that it aligns with your driving habits.

9. Don’t Over-Insure

While it’s important to have sufficient coverage, over-insuring can lead to unnecessarily high premiums.

- Home Insurance: Make sure your coverage is based on the cost to rebuild your home, not its market value.

- Auto Insurance: If you have an older vehicle, consider dropping comprehensive and collision coverage if the car’s value is low.

- Life Insurance: Choose a policy that covers your actual financial obligations, not more than you need.

Tip: Periodically reassess the value of your insured assets to avoid paying for coverage that exceeds their worth.

10. Work with an Independent Agent

Independent insurance agents aren’t tied to a single company, which means they can help you find the best deal across multiple insurers.

- Personalized Service: An independent agent can help you tailor your coverage to meet your specific needs.

- Ongoing Support: They can assist with policy reviews and claims, ensuring you always have the best coverage at the lowest price.

Tip: Look for an independent agent with good reviews and experience in the types of insurance you need. They can be an invaluable resource in your quest to save money on insurance.

7 FAQs About Affordable Insurance Tips

- What is the best way to find affordable insurance?

- The best way to find affordable insurance is to shop around, compare quotes from different providers, and take advantage of discounts.

- Can I lower my insurance premiums without reducing coverage?

- Yes, you can lower your premiums by raising your deductible, bundling policies, and maintaining a good credit score.

- What types of insurance can I bundle to save money?

- Common policies to bundle include auto, home, and life insurance. Some insurers also offer discounts for bundling renters, motorcycles, or boat insurance.

- How does my credit score affect my insurance rates?

- In many states, a higher credit score can lead to lower insurance premiums because insurers consider creditworthiness when determining rates.

- Is it worth increasing my deductible to save on premiums?

- Increasing your deductible can save you money on premiums, but make sure you have enough savings to cover the higher deductible in case of a claim.

- Are there specific discounts for home insurance?

- Yes, you can get discounts for installing security systems, smoke detectors, storm shutters, and more.

- What is usage-based auto insurance?

- Usage-based auto insurance uses telematics to monitor your driving habits and can offer lower premiums based on safe driving behavior.

- Usage-based auto insurance uses telematics to monitor your driving habits and can offer lower premiums based on safe driving behavior.

4o

our other websites https://futurefounderss.com/ wanna create a website? https://www.youtube.com/watch?v=JNU_rjsC7PY&t=1358s https://hpanel.hostinger.com/ https://aioseo.com/